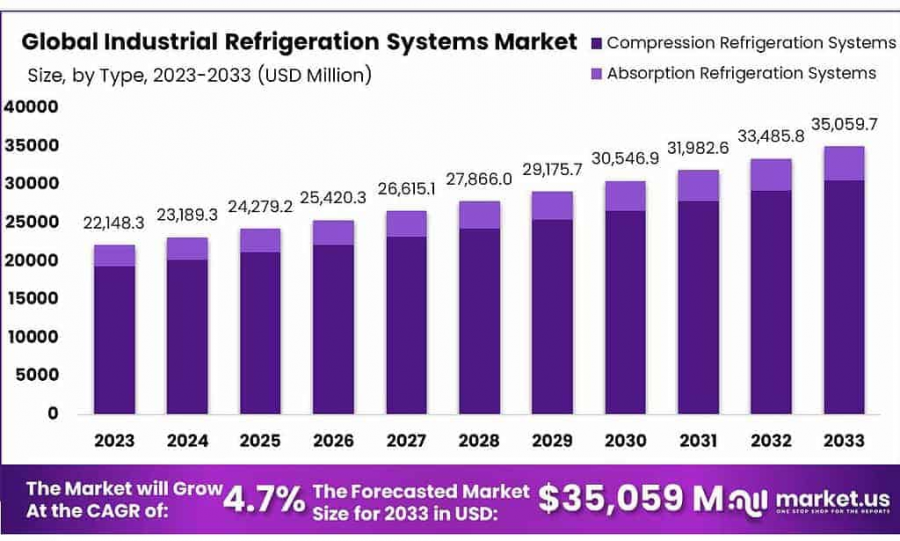

Industrial Refrigeration Systems Market To Hit USD 35,059.7 Million by 2033

Industrial Refrigeration Systems Market size is expected to be worth around USD 35,059.7 Mn by 2033, from USD 22,148.3 Mn in 2023, at a CAGR of 4.7%.

NEW YORK, NY, UNITED STATES, March 4, 2025 /EINPresswire.com/ -- The global Industrial Refrigeration Systems Market is projected to grow from USD 22,148.3 million in 2023 to USD 35,059.7 million by 2033, at a CAGR of 4.7%. These systems are essential for large-scale cooling applications across sectors such as food and beverage, pharmaceuticals, chemicals, and petrochemicals. Unlike residential or commercial refrigeration, industrial systems are designed for high-capacity operations, ensuring precise temperature control for storage, processing, and transportation.

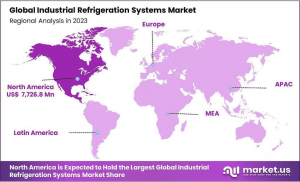

Key growth drivers include the rising demand for frozen and processed foods, stringent food safety regulations, and advancements in refrigeration technologies. The food and beverage industry dominates the application segment due to its reliance on refrigeration for preserving perishable goods. North America leads the market with a 34.9% share in 2023, while the Asia-Pacific is expected to register the highest CAGR of 6%.

Compression refrigeration systems are the most widely used due to their efficiency and scalability. Among refrigerants, ammonia remains the preferred choice, owing to its thermodynamic efficiency and cost-effectiveness. However, challenges such as high energy consumption and operational costs may restrain market growth.

Technological innovations like IoT-enabled systems and AI-based controls are transforming the market by improving energy efficiency and operational reliability. Additionally, regulatory trends promoting eco-friendly refrigerants present lucrative opportunities for market players.

Key Takeaways

* The market is expected to grow at a CAGR of 4.7% from 2023 to 2033.

* Compression refrigeration systems dominate the market with an 87.3% share in 2023.

* Ammonia is the most widely used refrigerant due to its efficiency.

* The food and beverage industry accounts for the largest application segment.

* North America leads in market share; Asia-Pacific is poised for rapid growth.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/industrial-refrigeration-systems-market/request-sample/

Experts Review

Government Incentives & Technological Innovations

Governments globally are incentivizing eco-friendly refrigeration technologies through subsidies and tax benefits. Innovations like IoT-enabled monitoring systems and AI-driven controls are improving energy efficiency and reducing operational costs.

Investment Opportunities & Risks

The market offers significant investment opportunities in sustainable refrigeration solutions due to growing environmental concerns. However, high initial costs and energy consumption pose risks for small enterprises.

Consumer Awareness & Technological Impact

Rising consumer awareness about food safety standards is driving demand for advanced refrigeration systems. IoT and AI integration enable real-time monitoring, predictive maintenance, and energy optimization.

Regulatory Environment

Stringent regulations on greenhouse gas emissions are pushing industries toward natural refrigerants like ammonia and CO2, creating both challenges and opportunities for manufacturers.

Report Segmentation

The industrial refrigeration systems market is segmented by type, component, refrigerant type, application, and region:

By Type: Compression refrigeration systems dominate due to their efficiency and adaptability; absorption systems cater to specialized needs.

By Component: Compressors lead with a 39.3% share due to their critical role in the refrigeration cycle.

By Refrigerant Type: Ammonia holds a significant share (59.8%) due to its cost-effectiveness and thermodynamic properties.

By Application: Food & beverage leads with a 28.6% share; other segments include refrigerated warehouses, transportation, chemicals, pharmaceuticals, and petrochemicals.

By Region: North America dominates with a 34.9% share; Asia-Pacific exhibits the fastest growth rate.

This segmentation highlights diverse applications across industries while emphasizing regional dynamics that shape market trends.

Key Market Segments

By Type

• Compression Refrigeration Systems

• Absorption Refrigeration Systems

By Component

• Compressors

- Reciprocating Compressor

- Screw Compressor

- Centrifugal Compressor

- Others

• Condensers

• Evaporators

• Controls

• Other Components

Refrigerant Type

• Ammonia

• Ammonia/CO2

• CO2

• Other Refrigerant Types

By Application

• Refrigerated Warehouse

• Food & Beverage

• Fruits & Vegetables

• Beverages

• Dairy and Dairy Products

• Meat, Poultry, and Fish

• Others

• Refrigerated Transportation

• Chemicals & Pharmaceuticals

• Petrochemical

• Other Applications

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=57548

Drivers, Restraints, Challenges & Opportunities

Drivers

Rising demand from the food & beverage sector for processed foods.

Technological advancements like IoT-enabled monitoring systems.

Global trade expansion requiring cold chain logistics.

Restraints

High energy consumption increases operational costs.

Initial capital investments deter small enterprises.

Environmental regulations necessitate costly eco-friendly upgrades.

Challenges

Limited access to affordable energy sources in developing regions.

Maintenance complexities of advanced systems.

Volatile raw material prices affecting manufacturing costs.

Opportunities

Growing adoption of sustainable technologies using natural refrigerants.

Increasing demand for customized solutions across industries.

Expansion into emerging markets driven by urbanization and industrialization.

Key Player Analysis

• Mitsubishi Electric Corporation

• Daikin Industries, Ltd.

• Johnson Controls International Plc

• Carrier Global Corporation

• Emerson Electric Co.

• Danfoss A/S

• Ingersoll Rand Inc.

• GEA Group AG

• SPX Technologies, Inc.

• Bitzer SE

• Baltimore Aircoil Company, Inc.

• Frick India Limited

• Other Key Players

These players emphasize R&D investments in natural refrigerants like ammonia and CO2 to comply with environmental regulations while enhancing energy efficiency. Mergers and acquisitions are common strategies; for example, Johnson Controls acquired M&M Carnot in June 2023 to expand its portfolio of low-GWP solutions.

Recent Developments

Recent developments highlight strategic acquisitions aimed at sustainability: In April 2023, Carrier Global Corporation announced a €12 billion acquisition of Viessmann Climate Solutions, reinforcing its commitment to sustainable technologies.

In June 2023, Johnson Controls acquired M&M Carnot to enhance its offerings in natural refrigerant-based solutions with low GWP. These moves reflect industry efforts toward aligning with global sustainability goals while expanding technological capabilities.

Conclusion

The Industrial Refrigeration Systems Market is poised for steady growth driven by technological advancements, regulatory shifts toward sustainability, and increasing demand from key industries like food & beverage. While challenges such as high energy consumption persist, opportunities in eco-friendly technologies offer significant potential for innovation and expansion. Major players continue leveraging R&D investments and strategic acquisitions to stay competitive in this dynamic landscape.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release